Business leaders, venture capitalists and market analysts agree a recession is looming. Without question, startup capital has become harder to raise. If you’re a startup CEO, it’s your job to make sure your company is successful over the long-term and reaches its fullest potential. A big part of that is how you lead your product teams through challenging moments like this so that your business not only survives, but is positioned to thrive on the other side.

Get Your Business Off the Ground

Let’s start with an analogy of flying a plane. To take off, the pilot starts at one end of the runway, hits the gas to produce thrust, and starts moving along. To get off the ground, the plane needs to be moving fast enough to generate sufficient lift to get in the air. From the first moment, the runway is limited—and the faster the plane moves, the shorter the runway appears. Pilots know it’s not about how much longer the runway will be under them, but about whether they can get to speed by the time the runway ends. So, they don’t hit the brakes, they hit the gas.

Getting a company off the ground is similar. Flight is profitability, runway is capital, the weight of the plane is overhead, and investment in product is thrust. Fortunately, CEOs have two levers that pilots don’t:

- Lever 1: Reducing weight by cutting unnecessary costs

- Lever 2: Extending the length of the runway by infusing capital

Too many CEOs have historically relied on pulling lever 2 over and over again. In the current economic climate, it’s far more difficult, so CEOs are correctly looking for ways to stretch the capital they already have. But I also see too many CEOs incorrectly looking at the high cost of product and engineering, and deciding to cut there. Cutting product investments that yield better unit economics is akin to deciding the engine weighs too much and cleaving it from the plane. Slowing down will make the runway last longer, but the plane is much less likely to ever get off the ground.

However, not all spend is of equal importance and not all product investments are of equal value. Investor expectations have shifted away from “growth at all costs” and toward “stronger unit economics”. So, regardless of the path you choose between acquiring more capital or becoming less dependent on it, your product investments should now be highly focused on more measurable, lower-risk, shorter-term improvements resulting in better unit economics.

Successfully Lead Your Product Teams Through a Recession

In either of the two paths outlined above, you will need to lead product teams in a similar way. Here is how you can successfully lead product teams through an uncertain economic future:

- Change the investment mix

- Ensure alignment with your product leader

- Invest in product now to position for growth later

- Document a vision and strategic plan with pivot points

1. Change the Investment Mix

With this shift in mindset, you’ll have to take a step back and think about the types of investments you’re making in the business. Each should be scrutinized across all functions and measured on whether it directly contributes to better unit economics and profitability.

Align Product Investments to Financial Performance

You’ll be comparing product investments to those in other areas such as marketing or sales, which tend to be extremely measurable. ROI of product investments is naturally harder to predict, so to keep the scales fair, ask your product leader to concentrate effort in areas where the ROI is easier to prove and in a shorter time frame than the team may be accustomed to. Product releases should produce meaningful customer-facing value, directly reduce cost, or have a pronounced measurable effect on existing customer retention or new customer LTV/CAC ratio.

Based on my experience, here are the most effective ways to improve customer retention immediately and measurably:

- Eliminate negative experiences that cause otherwise happy customers to churn

- Build in-product offers and experiences that convince churning customers to stay

- Build quick-win features requested by top customers

Rather than cutting evenly across the board, selectively pause those investments that are not focused on the core. Usually, product is the best (and sometimes the only) opportunity to positively impact unit economics.

Pause Major Investments in Infrastructure

For unprofitable companies still trying to get off the ground, consider whether high-ROI investments will pay for themselves before you run out of runway. Anything that pays off later than that is doing more harm than good. Long-term scaling initiatives may not be prudent at this time.

As a startup CEO, you should direct the team to only work on the technical debt that is absolutely necessary during the window in which you have runway so that you can save resources for other investments that will more directly affect unit economics. Only operational cost reduction and customer-facing product improvements will affect the gross margin, and therefore they should get the full attention of product development. Find ways to work around everything else.

Evolve Your Marketing Focus

Just like investments in product, marketing investments should be viewed through a similar lens of short-term impact. Marketing can support this organizational shift by focusing on customer relationship marketing to reduce churn and retain customers. Bottom-of-funnel campaigns designed to capture existing demand can also yield short-term returns. For example, you could offer discounts for prospects who have been on the fence about purchasing. Or, your marketing team can stand up search campaigns targeting keywords with particularly high purchase intent.

On the other hand, it may not make sense for you to invest in campaigns with a projected return on a 2-year time horizon. For example, you may consider pausing top-of-funnel campaigns and general brand marketing to trim down spend.

2. Ensure Alignment with Your Product Leader

According to Crunchbase, as of mid-November, more than 73,000 workers in the U.S. tech sector have been laid off in mass job cuts so far in 2022. If your company was forced to lay people off, you probably have your hands full managing employee morale. But you must also make sure leaders across your core business functions, including product, understand the new game and how to keep score.

Changes to your investment mix won’t be defensible unless your product leaders also understand the shift in organizational mindset, and how to translate it to prioritization decisions made by their team. The better your product leaders can showcase the ROI of product investments, the less likely you’ll be to cut critical initiatives that generate the thrust you need to take off. With this context in mind, if the product leader cannot demonstrate the impact of their efforts, then perhaps the innovation engine isn’t efficient enough and it should be scaled back so the cut line forces prioritization of only the very best bets.

For product leaders, it is “wartime”. Product leaders need steering power and flexibility in setting (and resetting) the strategic direction across teams. There will be pressure to focus on measurable outcomes and prove the ROI of product investments. As a CEO, here is how you can enable your product leaders during “wartime”:

- Communicate to the product leader how expectations have changed focusing more attention now on profitability and favorable unit economics over raw growth.

- Remove roadblocks for product teams when they are working to directly increase LTV or directly reduce CAC.

- Communicate constraints and push back on longer-term or unclear investment proposals. Let the product team know constraints in terms of timeline, budgets, and other dependencies.

3. Invest in Product Now to Position For Growth Later

Economic downturns and recessions come and go, but they don’t last forever. At some point the pendulum will swing back the other way. As the CEO, it’s your job to make sure the company is successful over the long-term and reaches its fullest potential not just through a downturn, but on the other side of it. Increasing the lifetime value of your customer today will afford you the ability, when the time is right, to shift back into growth mode from a position of relative strength.

You’ll be in a far better position than your customers having earned an ability to spend more on customer acquisition since your customers will be more valuable. This will allow you to grow at a faster clip when investor focus shifts back to growth or a more balanced point between the endpoints of the spectrum.

4. Document a Vision and Strategic Plan with Pivot Points

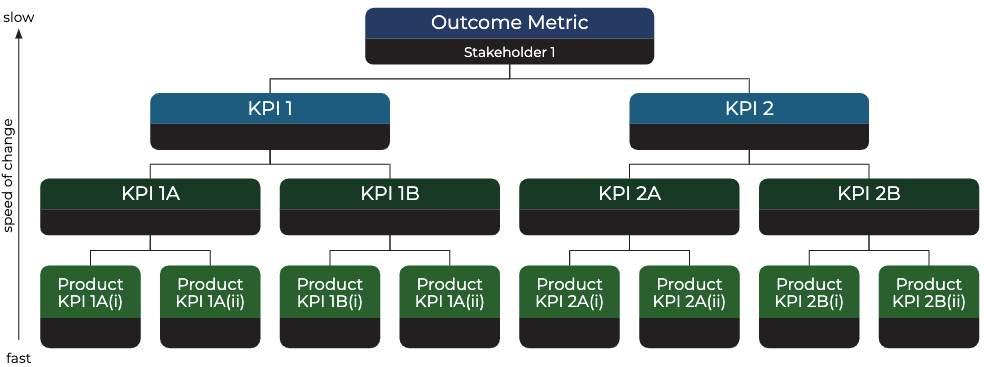

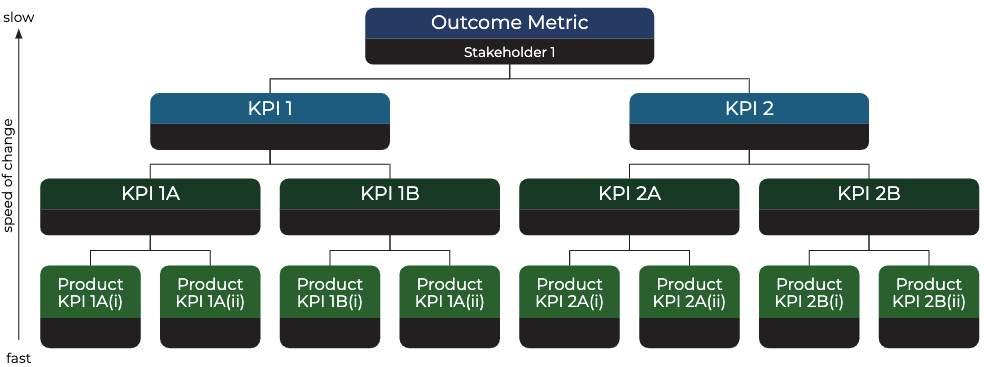

All product investments should be tied to a financial outcome, now more directly than ever. Enable your product leaders to develop a strategic plan that maps back to your core metrics, but also allows for reconsideration given constantly shifting market conditions and new learnings along the way. Prodify’s strategic planning services help you and your product leaders break down success measures into two KPI pyramids—one for your business and one for your customers. (see the image below).

This is one exercise in internal alignment on how to measure product success, which is both urgent and important for any company staring at a limited runway. Request a call with a team member to learn how we can help focus your product planning and optimize your product investments.